When Fashion Becomes Macro: How Tariffs Threaten the Industry from the Inside Out

An economic breakdown of how sweeping U.S. tariffs could reshape fashion — from supply chains to consumer sentiment to stock valuations.

The Moment Fashion Crossed into Macro Territory

Fashion wasn’t supposed to be part of the tariff story — at least not headline material.

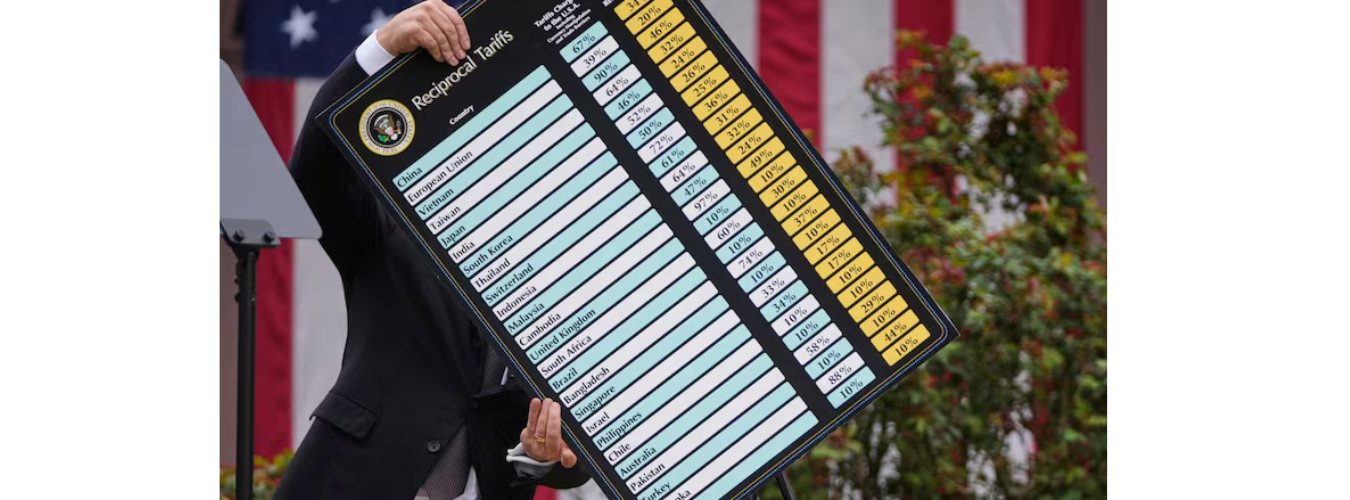

But on April 2nd, Trump announced a sweeping trade shift:

A 10% minimum tariff on every import

A 25% tariff on foreign-made automobiles

A new “reciprocal tariff” model targeting any country that taxes U.S. goods

And just like that, nearly every fashion-producing region — Vietnam, Bangladesh, India, Cambodia, Indonesia — landed in the blast radius.

This isn’t a niche disruption. This hits the core of how fashion operates: how things are made, how they’re priced, how they’re shipped, and who can afford them.

In other words: fashion just became a macro issue. And the ripple effects are only beginning.

Supply Chain Chaos (The Immediate Hit)

Trump’s April 2nd tariff rollout didn’t just target China — it hit nearly every major fashion sourcing hub with double-digit import taxes. Countries like Vietnam, Bangladesh, India, Cambodia, and Indonesia are all facing 30–50%+ tariffs, depending on product categories and trade history.

These countries aren’t footnotes in the industry — they are the backbone of global fashion manufacturing. Especially for fast fashion, mid-tier brands, and even parts of luxury supply chains (think: embellishments, trims, and handcrafted components).

For brands, there are only three real options — and none of them are painless:

Absorb the cost → Short-term fix, but margin pressure will spike.

Raise retail prices → Risky in a soft demand environment.

Reroute production → Expensive, slow, and operationally disruptive.

Even brands with diverse supplier networks will feel this. Many operate on tight production calendars. Shifting vendors or moving factories can take 12–18 months — and that’s if you have the infrastructure ready.

What happens next?

Lead times increase.

Quality assurance risks rise.

Deadstock may surge if production is rushed to meet outdated demand.

This isn’t just a hiccup in logistics. It’s the kind of disruption that ripples through collections, margins, and customer experience. And the effects will show up long before the product hits the shelf.

Rising Prices Across the Board

The pricing impact is already baked in. With production now more expensive across most major manufacturing countries, brands are going to have to decide what to do with that cost — and most won’t absorb it.

That means:

Apparel

Footwear

Bags

Accessories

...basically anything that’s made or assembled abroad is going to get more expensive.

This isn’t just a fast fashion problem. It’s going to touch luxury too — especially in the details:

Hardware

Leather sourcing

Custom trims

Zippers and metalwork (often produced in Asia, even for high-end brands)

The U.S. consumer — already stretched by inflation, rent, and interest rates — is going to start seeing price hikes that feel hard to justify.

We’re now in a climate where:

Entry-luxury could start looking too expensive for aspiration buyers

Mid-tier might lose its value proposition

Fast fashion’s cost advantage shrinks — and the margins go with it

Some brands might try to hold the line on prices and eat the squeeze. Others will inch prices up and hope no one notices. Either way, the era of quietly offshore production with stable pricing is gone — at least for now.

Margin Pressure on Retailers

Retailers are about to get squeezed from both sides.

On one hand, cost of goods sold is going up — thanks to tariffs, longer lead times, and production rerouting. On the other, consumers are increasingly price-sensitive and already cutting back on discretionary spending.

For multi-brand retailers — think Macy’s, Nordstrom, SSENSE — it’s a tough spot. They don’t control manufacturing, but they’ll still be held responsible for price increases. Their options aren’t great:

Cut back on assortment to avoid overstock risk

Push private label to reclaim margin

Discount aggressively just to move product

Even luxury retailers won’t be totally insulated. If mid-tier brands start discounting to survive, it puts indirect pressure on the rest of the ecosystem.

Inventory misalignment — ordering for one kind of customer behavior, and getting another — could become the new normal. And with demand softening, even modest margin erosion can start to compound quickly.

Onshoring Hype — But Not Reality

“Made in America” is about to make a comeback — not in production volume, but in marketing decks and political talking points.

It’s a clean, patriotic narrative. Bring jobs home. Control the supply chain. Ditch dependency on Asia.

But here’s the thing: it’s not realistic at scale.

The U.S. doesn’t have the manufacturing capacity, labor pipeline, or infrastructure to suddenly take back a globalized industry. Most brands don’t have factories here. Most workers don’t have garment experience. Most cities don’t have the zoning, permitting, or equipment ready to go.

And the cost? Way too high.

Yes, automation is evolving — but not fast enough to close the gap by next season.

So while onshoring will get talked about (a lot), don’t expect it to reshape the industry anytime soon. At best, we’ll see:

Limited capsule collections made in LA or New York

Small-batch runs for PR or patriotism

A few legacy brands leaning into heritage positioning

That’s not scale. That’s branding.

Rethinking Nearshoring & Regional Hubs

If Asia’s getting hit with heavy tariffs and America’s not built for production — that leaves the middle ground: nearshoring.

A lot of brands are already exploring it. Countries like Mexico, Honduras, Colombia, and parts of Eastern Europe have been quietly gaining traction as fallback sourcing zones.

The appeal:

Faster shipping to North America and Europe

Reduced tariff exposure

Lower political risk compared to China or Southeast Asia

But nearshoring isn’t a magic fix. These regions can’t yet match Asia’s scale, speed, or price — especially when it comes to high-volume categories like denim, basics, or synthetics.

So yes, this strategy might gain momentum. But it’s a long game. Infrastructure still needs to be built out. Labor still needs to be trained. Supply networks still need to mature.

Brands like Levi’s, PVH, and Nike have been laying groundwork here for a while. Now others may be forced to catch up — not out of preference, but survival.

Stock Market Fallout (Investor Sentiment Shift)

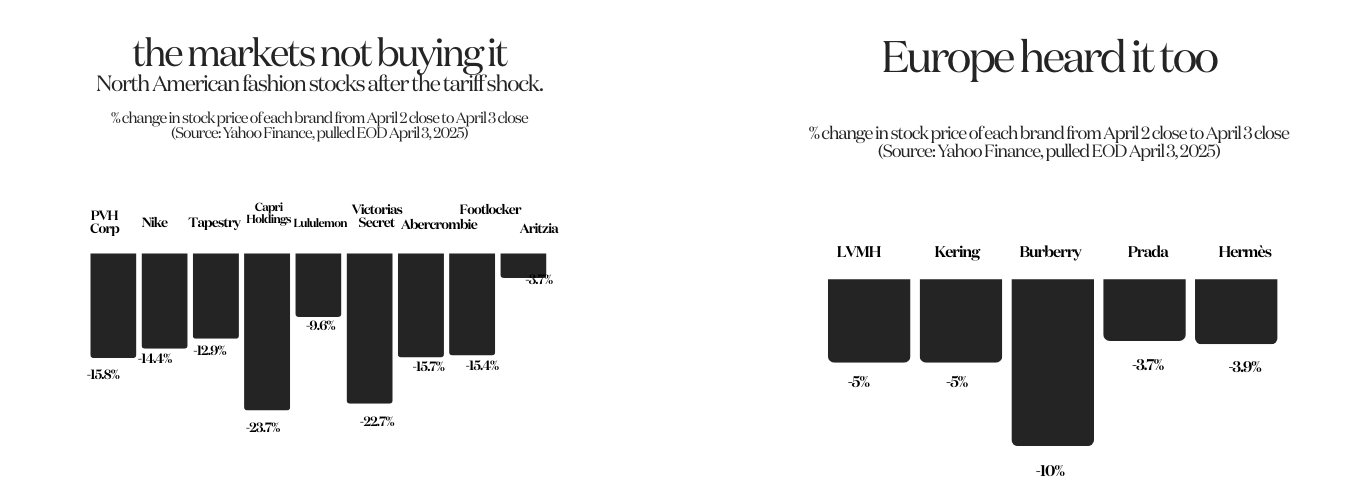

Wall Street doesn’t wait for supply chain delays to kick in — it starts pricing in damage the moment policy changes hit.

Since the tariff announcement, we’ve already seen market reactions from both luxury and athletic brands. Stocks like Lululemon, Burberry, Kering, and Nike all dipped, while analysts begin adjusting for margin pressure, softening demand, and sourcing exposure.

Fashion is now officially a macro-sensitive sector. Investors are asking:

How exposed is your production to tariffed regions?

How much pricing power do you actually have left?

Can you cut costs fast enough without cutting brand equity?

Some brands got hit harder than others. Capri Holdings dropped 23.7%, Victoria’s Secret fell 22.7%, and PVH slid 15.8%. Abercrombie, Foot Locker, and Nike weren’t far behind, all down between 14–16%. Even Lululemon — typically seen as a premium growth play — slipped nearly 10%.

In Europe, Burberry dropped 10%, while Hermès and Kering saw more muted declines around 4–5%. Prada slipped 3.7%, signaling a global pricing-in of risk — especially for brands deeply tied to Asian production or U.S. consumer demand.

This is more than a short-term correction. It’s a repricing of risk — and a potential signal that fashion stocks may no longer be buffered from global macro shocks.

This isn’t just an operations issue anymore — it’s hitting market confidence in real time.

And if these tariffs stick, a valuation reset may already be underway.

Consumer Confidence Collapse

This isn’t just a supply-side problem. It’s also a consumer-side one — and the mood is shifting fast.

U.S. consumer confidence was already sliding before the tariffs dropped. Inflation fatigue, rising interest rates, and student loan repayments have been eating into discretionary spending for months.

Now throw tariff-induced price hikes into the mix, and fashion — especially non-essential fashion — becomes an even harder sell.

What does that look like in practice?

Entry-luxury brands (Tory Burch, Coach, Michael Kors) might see aspiration buyers pull back

Mid-tier shoppers lean further into resale, dupes, and discount platforms

Fast fashion’s core customer may not tolerate a price bump, even if it’s just $5

And it’s not just about price. It’s about perception. If people think everything is going to keep getting more expensive, they delay purchases. That delay, at scale, starts to hit revenue.

Consumer psychology is about to become just as important as product strategy.

Sustainability Goals Get Delayed

Let’s be honest: ESG takes a backseat when margins are under pressure.

Brands that spent the last few years ramping up sustainability efforts — from recycled fabrics to carbon-neutral shipping — are now facing hard decisions. Because tariffs don’t just raise costs on finished goods. They raise costs on everythingin the production pipeline.

That means:

Sustainable materials that were already more expensive are now even harder to justify

Slower, lower-carbon shipping routes may get swapped for speed and cost-efficiency

Certifications and compliance checks might quietly get de-prioritized

It’s not that the sustainability narrative disappears. It’s just that behind the scenes, margin protection wins out.

For brands that built their whole identity around ethical production, this is a dangerous corner. For everyone else, ESG becomes something they put on pause — and pick back up once the volatility settles.

DTC Shakeout Coming

The direct-to-consumer space has been shaky for a while. Tariffs might be the thing that finally breaks some of it.

Most smaller DTC brands rely on Asian manufacturing — it’s how they keep margins healthy while offering “premium at a better price.” Now? That cost advantage disappears fast.

The options aren’t great:

Raise prices and risk alienating the exact customer they built their brand on

Absorb the cost and watch already thin margins collapse

Move production — which is a massive operational lift most of them aren’t set up for

Shipping delays and fulfillment issues will only pile on. Some may shift to warehousing in the U.S. to dodge duty charges at the border. Others won’t survive the extra friction.

Expect to see:

Quiet pivots (sudden markdowns, stealth layoffs)

Brand acquisitions from bigger players looking to scoop up distressed assets

A return to wholesale for some, just to stabilize revenue

If the last few years were about DTC explosion, this era might be about DTC consolidation — or straight-up collapse for the ones that can’t adapt.

Resale & Rental = Winners in the Chaos

While the rest of the industry scrambles, resale and rental might quietly win this moment.

If new goods are getting more expensive, slower to ship, and harder to justify… secondhand starts to look a lot more attractive. Especially for shoppers who still want the look, just not the markup.

Platforms like The RealReal, Vestiaire Collective, Depop, Grailed — all benefit from this shift. They’ve already normalized used goods in the luxury and streetwear space. Tariffs just make that pivot more appealing.

Rental might ride the same wave. Rent the Runway and smaller players could position themselves as the inflation-proof fashion solution — access over ownership, vibes over full price.

None of this solves the industry’s deeper challenges. But in the short term, it’s a pressure valve. Consumers still want newness. These models just offer a cheaper, faster, more flexible way to get it.

Creative Direction & Product Strategy Will Shift

When costs go up across the board — raw materials, trims, freight, labor — creative decisions start to look different.

Design teams will be forced to think leaner:

Fewer fabrics per collection

Simpler silhouettes

Minimal hardware and embellishments

Less experimentation, more tried-and-true sellers

Expect to see more capsule collections, modular wardrobes, and product storytelling built around versatility and longevity — not maximalism or trend-chasing.

It won’t just be an aesthetic choice. It’ll be about cost control.

For some brands, this will align perfectly with existing DNA. For others, it’ll expose how fragile their product strategy really is when the economics shift.

In the end, the new constraints will drive new design rules. Whether that’s a creative renaissance or a period of risk aversion depends on who adapts fastest.

Final Thought: Fashion’s New Playing Field

The tariffs are just the headline.

What’s underneath is a slow-moving disruption that touches everything — sourcing, pricing, design, retail, consumer behavior, even brand equity.

Fashion isn’t just reacting to trade policy anymore. It’s being shaped by it.

Every player in the space — from fast fashion giants to legacy luxury houses — now has to think like a macro strategist:

How exposed are we to geopolitical risk?

How flexible is our sourcing model?

What happens if consumer demand softens for a full year?

The answers aren’t simple. But what’s clear is this:

Fashion isn’t insulated from the world’s volatility. It’s part of it now.

And how brands respond in the next six months might define the next six years.