Luxury Pulse: Q1–Q3 2024 in Review

Image Courtesy of Bottega Veneta

2024 has been a transformative year for the luxury industry, navigating a labyrinth of global challenges and opportunities. From geopolitical tensions to shifting consumer preferences, luxury brands have proven their resilience and adaptability in the face of uncertainty. As we dissect the performance of leading players like LVMH, Kering, Hermès, Prada, Richemont, Capri Holdings, and Tapestry, the numbers reveal a tale of triumphs and trials.

This blog post takes a closer look at how these giants fared in the first three quarters of the year—unpacking revenue trends, market dynamics, and standout performances. Whether it’s Gucci’s ongoing repositioning, Hermès’ dominance in leather goods, or Prada’s Miu Miu emerging as a cultural phenomenon, the luxury world is evolving in fascinating ways. Let’s explore the stories these numbers tell.

Summarizing Each Company (Q1-Q3 2024)

LVMH

Key Strengths: Fashion & Leather Goods remained the top-performing segment, driven by brands like Louis Vuitton and Dior. Resilient growth in Asia-Pacific and Europe.

Challenges: Slower growth in the U.S. market, impacted by shifting consumer trends.

Overall Story: LVMH solidifies its dominance, leveraging brand equity and strategic partnerships (e.g., Formula 1 collaboration). Despite global uncertainty, they continue to lead the luxury sector.

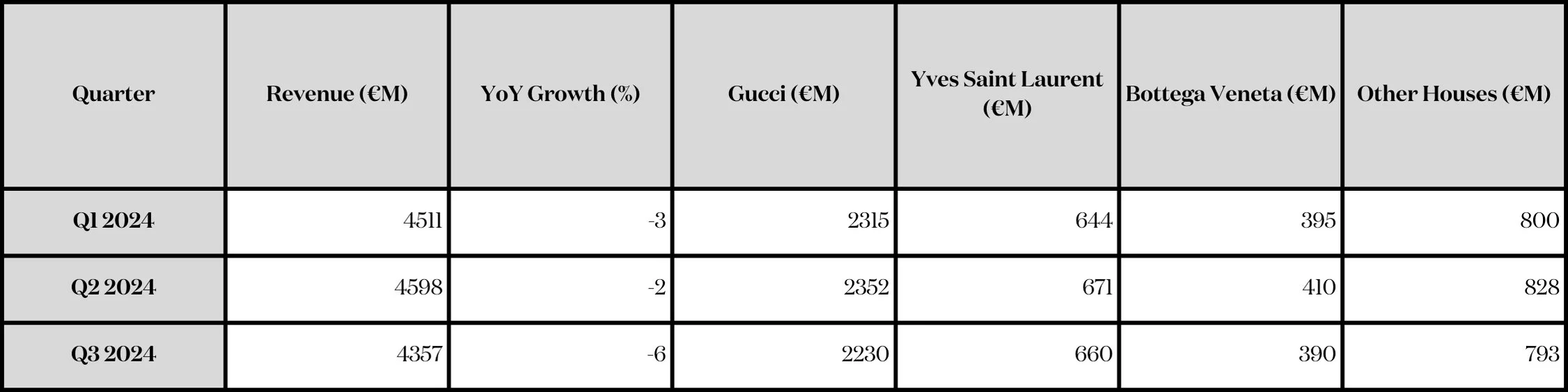

Kering

Key Strengths: Yves Saint Laurent and Bottega Veneta showed steady growth, benefiting from strong product launches and regional strategies.

Challenges: Gucci struggled to regain momentum, with YoY revenue declines signaling continued brand repositioning issues.

Overall Story: While some brands thrived, Kering’s flagship Gucci is under pressure. Their long-term success hinges on the effectiveness of Gucci’s strategic overhaul.

Hermès

Strengths: Exceptional growth in Leather Goods, maintaining high operating margins (above 36%). Strong performance in Asia-Pacific, with steady contributions from Ready-to-Wear.

Challenges: Managing demand for exclusivity while expanding store networks.

Overall Story: Hermès continues to outpace competitors with its craftsmanship and exclusivity, securing double-digit growth even in challenging markets.

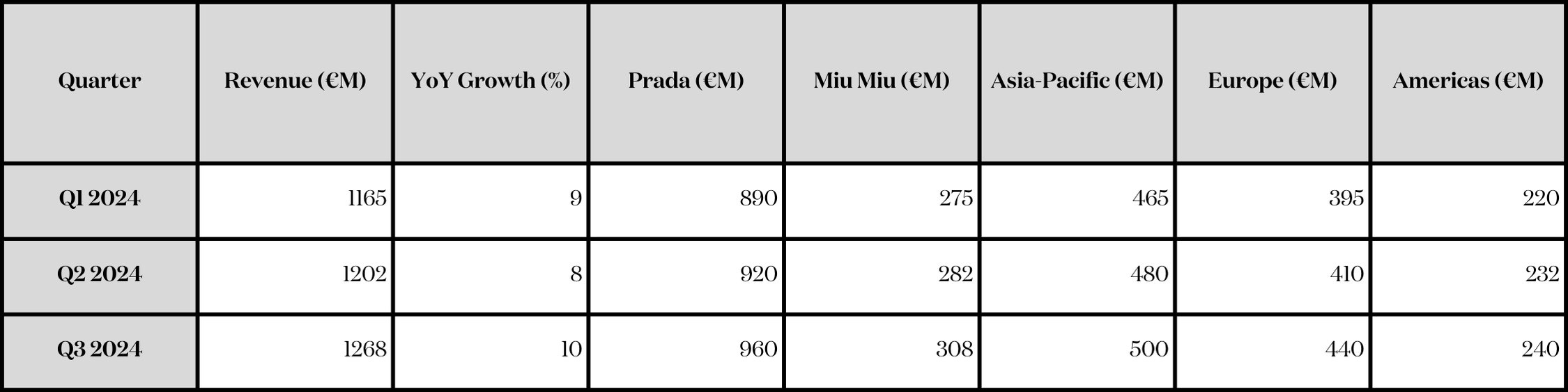

Prada

Key Strengths: Miu Miu’s meteoric rise (near 97% YoY growth in certain segments) and robust recovery in Asia-Pacific.

Challenges: Americas showed slower recovery, highlighting potential market-specific challenges.

Overall Story: Prada Group leverages Miu Miu’s success and digital expansion to strengthen its market position. Sustainability initiatives like Re-Nylon resonate with conscious consumers.

Richemont

Key Strengths: Jewellery Maisons like Cartier and Van Cleef & Arpels drove strong results, particularly in Asia-Pacific. Margins remained healthy despite challenges in Watchmaking.

Challenges: Specialist Watchmakers underperformed slightly, reflecting market-specific pressures.

Overall Story: Richemont stays anchored in Jewellery Maisons’ success, positioning itself well for continued growth in high-value categories.

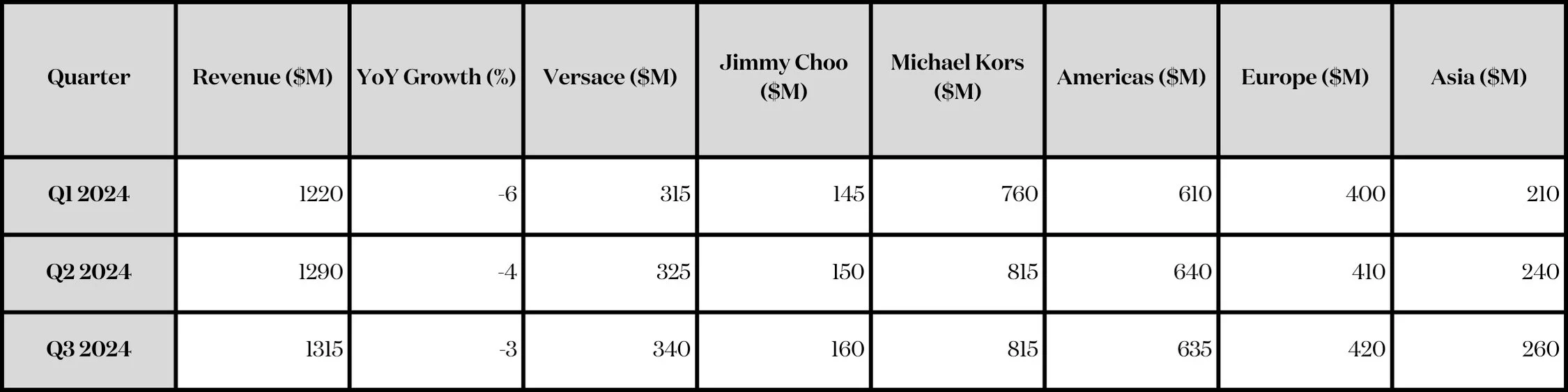

Capri Holdings

Key Strengths: Versace showed steady growth, with new collections gaining traction globally. Regional diversification supported stability.

Challenges: Jimmy Choo and Michael Kors struggled with declining revenues and market saturation.

Overall Story: Capri faces headwinds, with flagship brands needing reinvigoration. The upcoming merger with Tapestry could redefine its trajectory.

Tapestry

Key Strengths: Consistent growth from Coach, which remains the strongest brand in the portfolio. Europe showed robust gains, driven by younger consumers.

Challenges: Stuart Weitzman continues to underperform, pulling down overall results.

Overall Story: Tapestry’s stability is anchored in Coach and its growing European presence. Their ability to integrate Capri Holdings will define future growth.

What’s Next for Luxury?

As we anticipate the final quarter of 2024 and the release of annual reports, the luxury industry remains at an inflection point. With sustainability, digital innovation, and geopolitical factors reshaping the global market, the stage is set for both challenges and opportunities. Will legacy brands continue to lead, or will emerging disruptors redefine the future of luxury?

Stay tuned for a deep dive into the full-year performance, where we’ll unravel the impact of major campaigns, iconic product launches, and economic trends. For now, the Q1–Q3 data paints a compelling picture of resilience, creativity, and the enduring allure of luxury.