Athletic Fashion in Focus – Q1 to Q3 2024 Performance Review

Image courtesy of New Balance

As we approach the holiday season—a time synonymous with shopping—it's essential to reflect on the economic landscape shaping consumer behavior. In 2024, the global economy has faced significant challenges, including geopolitical tensions, supply chain disruptions, and rising inflation. These factors have collectively influenced consumer spending patterns. According to the International Monetary Fund's October 2024 World Economic Outlook, global growth remains stable yet subdued, with risks tilted to the downside. Additionally, the report highlights concerns such as extreme weather events and socio-political polarization impacting economic stability. Despite these headwinds, consumer spending has shown resilience. McKinsey's analysis indicates that U.S. consumer optimism reached its highest level in a year during the third quarter of 2024, translating into a greater willingness to spend, particularly in discretionary categories. In this context, the performance of athletic fashion brands offers valuable insights into market dynamics. Let's examine how key players have fared in the first three quarters of 2024 and anticipate their trajectories as we enter the crucial fourth quarter.

Let's talk about sportswear. While fashion as a whole continues to face headwinds, the sportswear sector has proven not only resilient but remarkably innovative, outperforming the broader fashion market. Sportswear isn't just for the gym anymore; it has seamlessly integrated into our daily wardrobes. From dominating the streetwear scene to pairing effortlessly with high-fashion pieces, athletic brands are rewriting the rules. According to The State of Fashion 2025 by Business of Fashion and McKinsey, challenger brands like ON and Hoka are forecasted to generate over half of the segment's economic profit in 2024, marking a dramatic rise from just 20 percent in 2020. Their success stems from targeted innovations, compelling brand storytelling, and strategic ambassador partnerships that resonate deeply with modern consumers. As consumers continue to blur the lines between athleticwear and everyday fashion, the battle for market share between legacy brands like Nike and Adidas and challengers like Lululemon and Deckers’ Hoka is intensifying. This convergence of functionality and style positions the sportswear sector as a defining force within the fashion industry. With Q1–Q3 2024 results now available, let’s dive into the numbers to see how these brands have performed so far—and what this might mean for the highly anticipated year-end results.

Cross-Brand Analysis: A Look at Performance and Trends

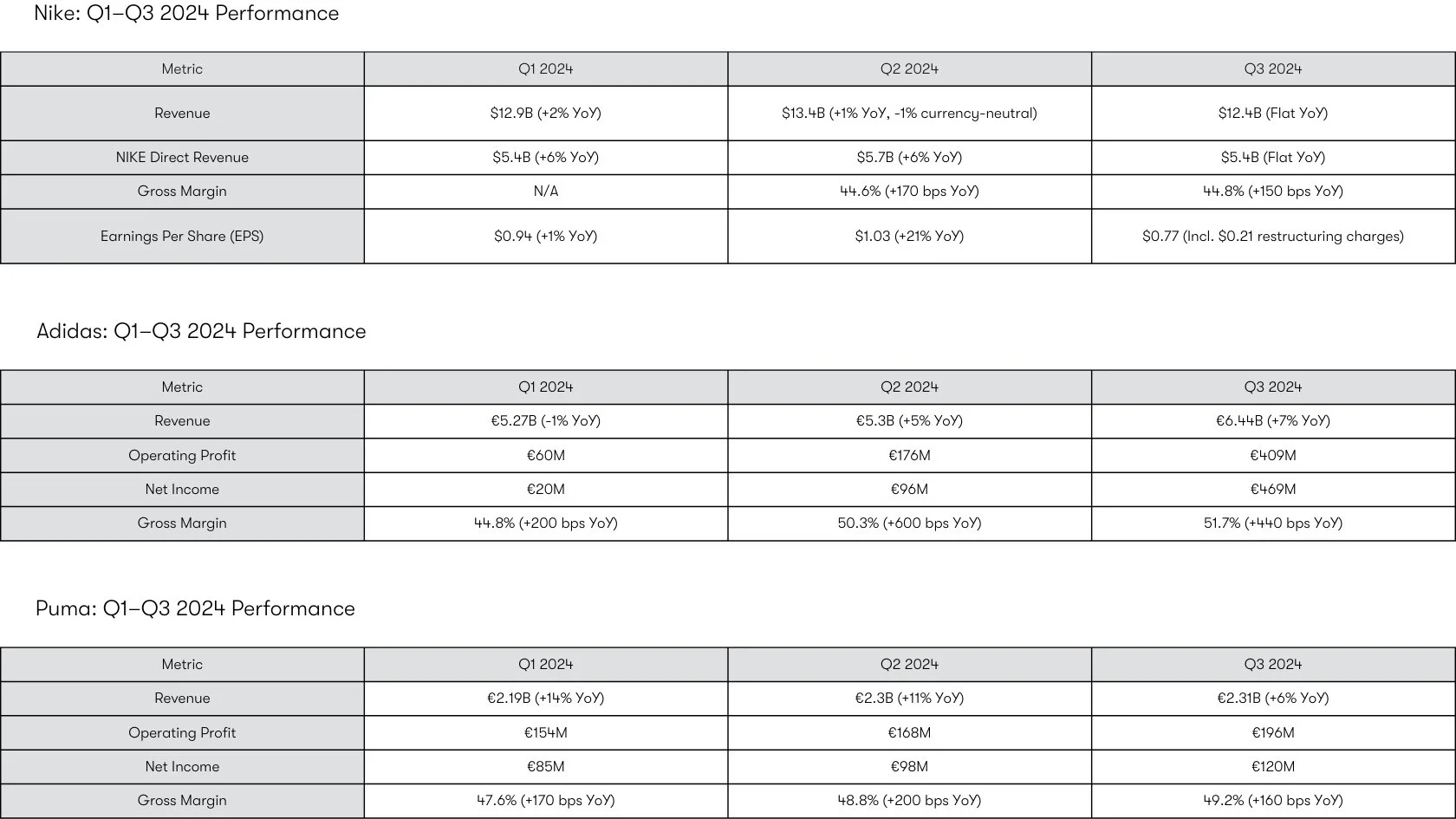

Key Highlights:

Q1 2024: Strong growth in NIKE Direct Revenue (+6% YoY), showcasing the success of the brand's consumer-focused strategy.

Q2 2024: Continued strength in direct revenue and gross margin expansion, with a notable 21% increase in EPS.

Q3 2024: Challenges in revenue growth, though profitability improved with higher gross margins despite restructuring charges.

Anticipating Fourth Quarter: Nike faces the challenge of sustaining profitability amidst global uncertainty. Holiday season performance and strategic adjustments will be critical to its Q4 success.

Adidas: Q1–Q3 2024 Performance

Key Highlights:

Q1 2024: A slow start due to inventory challenges and legacy Yeezy-related losses.

Q2 2024: Strong recovery with improved gross margins and renewed demand in lifestyle sneakers.

Q3 2024: Momentum continued with significant profitability gains in Greater China.

Anticipating Fourth Quarter: Adidas will rely on continued growth in its lifestyle segment and regional strategies to drive holiday-season success. Challenges include maintaining strong margins and combating increased competition.

Key Highlights:

Q1 2024: Strong growth in North America and EMEA markets, with performance driven by running and football segments.

Q2 2024: Continued double-digit revenue growth through product launches like Speedcat sneakers.

Q3 2024: Solid profit growth, though revenue growth slowed slightly.

Anticipating Fourth Quarter: Puma’s balanced global approach and focus on premium product categories position it well for Q4. Risks include competition and fluctuating regional demand.

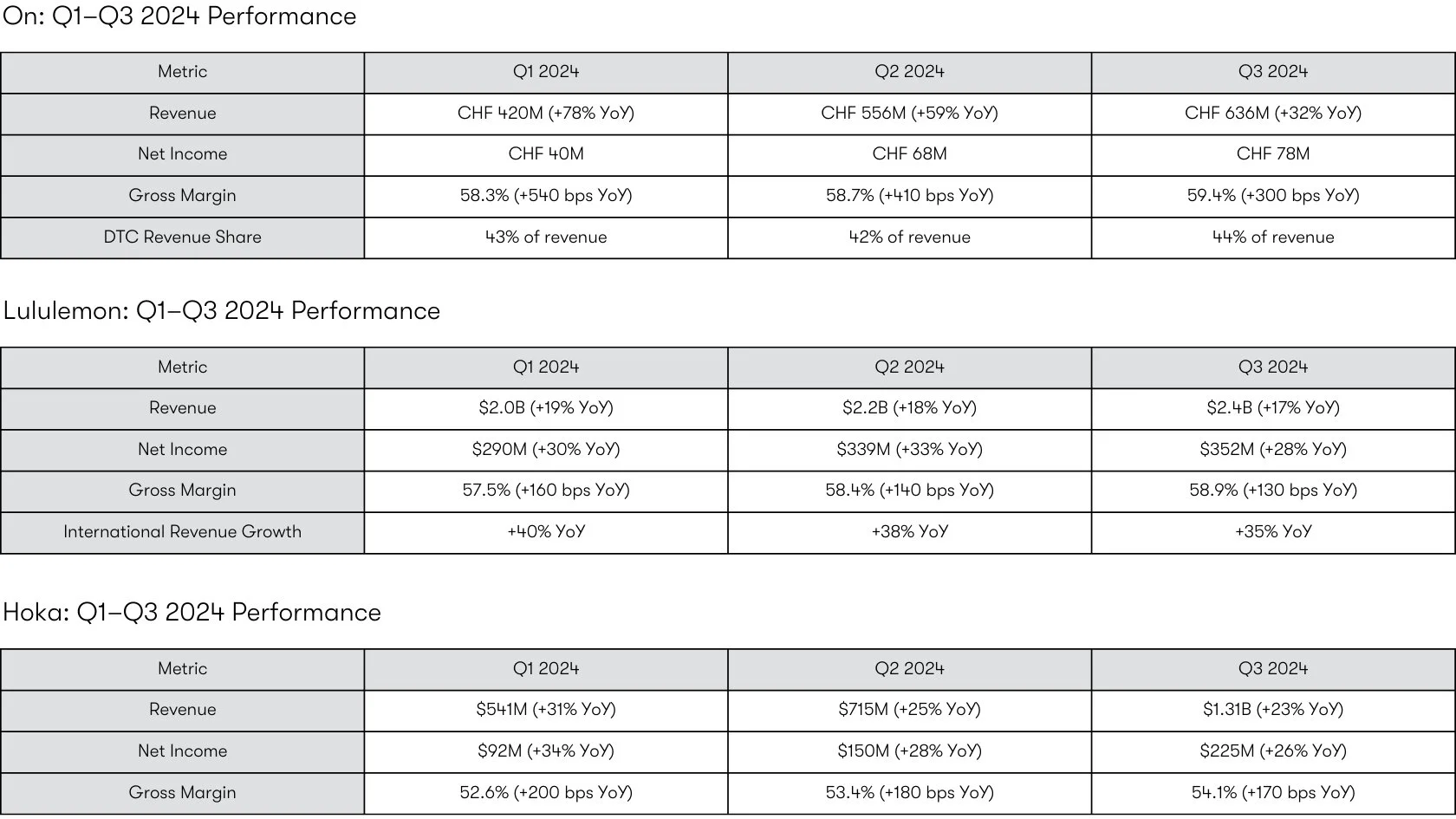

Key Highlights:

Exceptional growth across all quarters, fueled by strong demand for innovative footwear like Cloudmonster.

DTC channels have played a major role in ON’s profitability and customer engagement.

Anticipating Fourth Quarter: ON’s strong DTC momentum positions it for robust holiday sales. However, maintaining high growth rates amidst competitive pressures will be a challenge.

Lululemon: Q1–Q3 2024 Performance

Key Highlights:

Strong international expansion and new product launches have driven consistent growth across all quarters.

Anticipating Fourth Quarter: Lululemon will rely on its strong brand equity and DTC channels for a successful holiday season.

Hoka (via Deckers): Q1–Q3 2024 Performance

Key Highlights:

Hoka’s innovative footwear and DTC expansion have been key drivers of growth throughout 2024.

Anticipating Fourth Quarter: The holiday season will test Hoka’s ability to maintain its rapid growth, especially against legacy competitors.

Key Comparisons Across Brands

Revenue Growth:

Challenger brands like ON (+59% to +78% YoY in Q1–Q3) and Hoka (+23% to +31% YoY) outpaced legacy players like Nike (flat to +2% YoY) and Puma (+6% to +14% YoY).

The high growth of challengers underscores their ability to capture market share through innovation, niche targeting, and DTC channels.

Profitability Trends:

Lululemon led the pack with sustained gross margins of over 57%, indicating its premium positioning.

Legacy brands like Nike and Adidas improved profitability through restructuring efforts and gross margin expansion, though their YoY revenue growth lagged behind.

Direct-to-Consumer (DTC) Focus:

ON and Hoka consistently achieved over 40% of revenue through DTC channels, a strategy that enhances brand loyalty and margin control.

Legacy brands like Nike and Adidas balanced DTC with wholesale, showcasing adaptability in their distribution strategies.

Regional Growth:

Adidas saw a resurgence in Greater China, while Lululemon excelled in international markets with +35% YoY growth in Q3.

This regional strength highlights the importance of localized strategies in maintaining global relevance.

Findings

Challenger Brands Are Winning the Growth Game: With aggressive revenue growth and innovative product launches, brands like ON and Hoka are leading the charge, while New Balance continues to expand its market share with retro-inspired designs.

Legacy Brands Show Mixed Results: While Nike and Adidas maintain dominance, their slower revenue growth compared to challengers highlights the need for further innovation and market responsiveness.

Profitability Takes Center Stage: Across the board, gross margin improvements reflect a strong focus on cost control and pricing strategies.

The DTC Revolution: Challenger brands’ success in DTC is shaping the industry's trajectory, forcing incumbents to rethink their distribution strategies.

Conclusion: The Year Ahead in Focus

As we await the year-end results for 2024, the stage is set for a compelling showdown in the sportswear sector. Will challengers continue to outpace legacy players, or will the incumbents reclaim their dominance with bold strategies and innovation?

Sportswear has consistently outperformed broader fashion categories, with its integration into lifestyle and streetwear driving demand. According to The State of Fashion 2025, challenger brands are expected to generate the majority of the segment’s economic profit this year—a trend likely to persist. How this impacts the overall fashion market growth remains to be seen.

Stay tuned for our year-end wrap-up, where we’ll dive into full-year financials, analyze key milestones, and explore how the sportswear sector stacks up against the broader fashion industry in 2024. Let’s see who comes out on top as we look forward to an exciting year in 2025!